Ananda

The Bunker Group

ASML’s Current Battleground Now In China On Several Fronts (NASDAQ:ASML)

ASML dominates the lithography market but component shortages resulted in missed revenues and weak guidance. Learn more about ASML stock here.

This is one of the site use by market analyst on shares movement in the market. This one shown the analysis on ASML shares movement trend. Basically shown how ASML worries on:

1. US sanction that prevent them on entering China market,

2. Emergence of Chinese competitor (in this SMEE) as results of that.

The article that I put on previous post talking about the results of their research on Litograph machine.

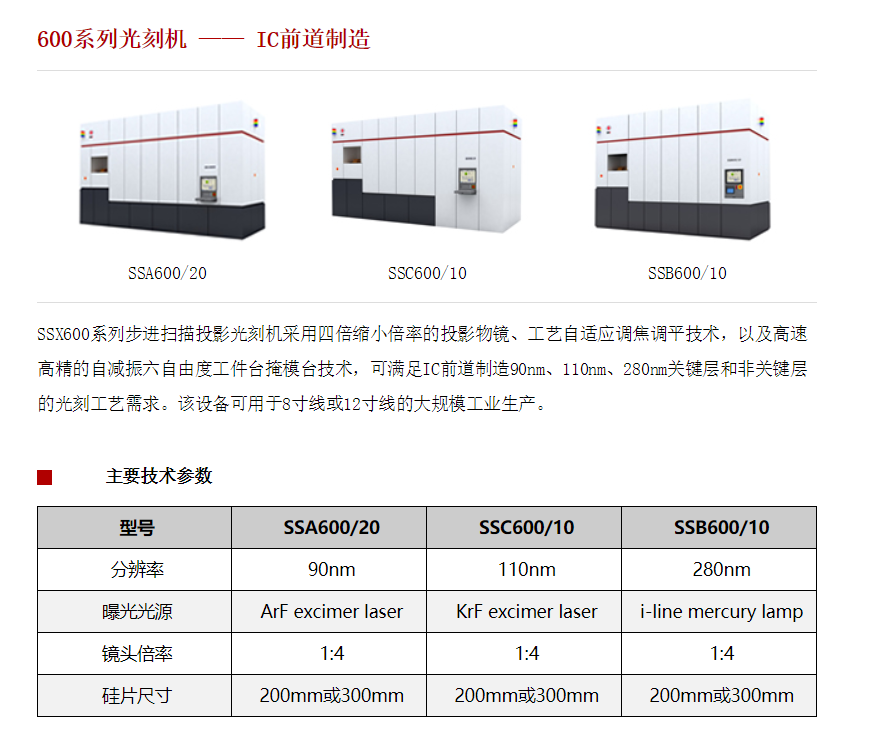

As the market analyst put, SMEE already have since 2020 working Litograph machine for 90nm node. So the link that you put on China basically has no experience in this area is not correct. SMEE Litograph machine already in the market. However SMEE machine not yet at par with ASML or Nikon (I forgot about Nikon, as the 2nd players in Litograph machine is Nikon and not Hitachi as I put in my previous post).

The question is whether SMEE already able to breakthrough toward 22-28nm node. Currently their model in market SSA600/20 only able for 90nm mode, but they already talking to market of SSA800 for 28nm and SSA900 for 20nm. If they do, it is not far to get them toward 7nm node which ASML and Nikon working on right now.

This is what make market leader ASML worries, as before the sanctions, China has less incentive to pour money and subsidise Indigenous Litograph machine producer like SMEE to catching fast with ASML. The article on my previous post shown how China research institution help SMEE to break into 20nm-28nm node as company plan.

So, China already have technology for DUV Litograph Machine, even Russian Rostec also has it (even from latest info it is still redevelopment from what Soviet era stage). However before the sanction, Chinese semiconductor foundry like SMIC has no incentive to work with SMEE as they can get the latest tech Litograph machine from ASML and Nikon.

What US tech sanction does is to give incentive for China to invest significantly in helping their local Litograph producers like SMEE. While their foundries will then absorb SMEE products, thus provide large captive market. Those money to catch up the tech are not from foreign investors, but PRC national coffer. Relying on their own cash flow it is doubt full smaller player like SMEE can catch up with ASML and Nikon fast.

Add:

Even Chinese source not all untrustworthy no matter how's your feel with PRC. Just try to see if the noise already large enough. When it is large enough, then there is base on that. As for me, if enough market analysts believe it is something to ponder on, then usually it is something solid to base on that.

Last edited: