This report offers insights into market opportunities and entry strategies adopted by foreign OEMs to gain a market share in the Indian defense industry.

The Indian defense industry is one of the fastest-growing global defense markets. India’s defense capital expenditure, which refers to the part of the defense budget that is spent on the acquisition of all types of military hardware and technology, has grown at a CAGR of XX% over the review period. In 2010, India was allocated US$XX billion for defense capital expenditure in the budget. Defense expenditure is expected to record a CAGR of XX% during the forecast period, to reach an annual expenditure of US$XX billion by 2016. This is primarily due to the country’s ageing military hardware and technology which is in need of replacing, and demands for defense against domestic insurgencies and hostility from neighboring countries. The strong growth in the industry is attracting foreign original equipment manufacturers (OEMs) and leading companies from the domestic private sector to enter the market. Moreover, terrorism is leading to sharp increases in the defense budget and a shorter sales cycle, which offers an attractive market for defense manufacturers.The country is especially expected to demand unmanned combat aerial vehicles (UCAVs), advanced electronic warfare systems, combat systems, rocket and missile systems, fighter and trainer aircraft, stealth frigates, and submarines during the forecast period. In addition, its expenditure on IT and communications is expected to increase significantly, with a strong focus on enterprise applications, systems integration, and real-time mobile communications.The country relies upon imports to procure defense equipment with advanced technology, and, since most of the equipment India is seeking use advanced technology, there will be a significant prospect for foreign OEMs to enter the Indian defense market.

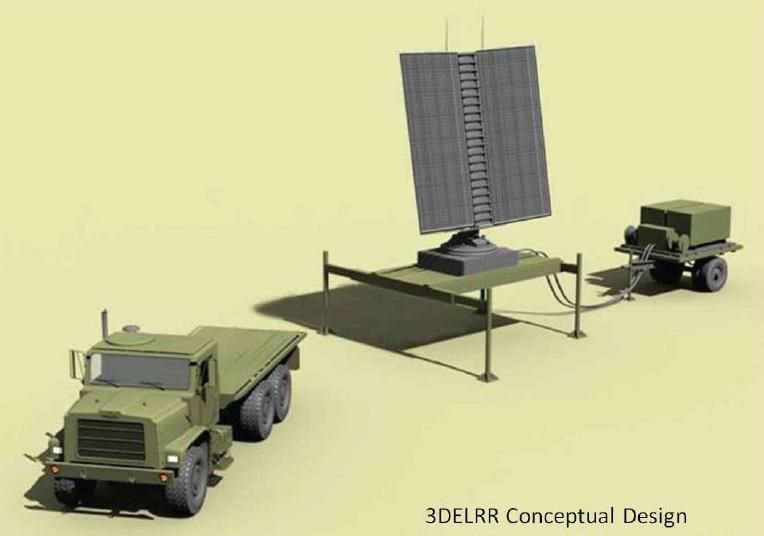

Government spending on India’s homeland security market has increased significantly as a result of terrorist attacks, the smuggling of arms and explosives, and domestic insurgency. In 2010, the country’s homeland security budget registered an increase of XX% over the previous year, with the Central Reserve Police Force (CRPF) receiving the largest share of the budget. Due to the nature of the security threats which the country faces, the main opportunities for growth in homeland security are expected in the aviation, mass transportation and maritime security markets. Following the increase in both domestic and foreign terrorist attacks, spending is expected to increase in surveillance technology, global positioning systems, radars and biometric systems.

In particular, it offers in-depth analysis of the following:

- Market opportunity and attractiveness: Detailed analysis of the current market size and growth expectations during 2010–2016, including highlights of the key drivers, to aid understanding of the growth dynamics. It also benchmarks the sector against key global markets and provides detailed understanding of emerging opportunities in specific areas.

- Procurement dynamics: Trend analysis of imports and exports, along with their implications and impact on the Indian defense industry.

- Industry structure: Five forces analysis to identify various power centers in the industry and how these are likely to develop in the future.

- Market entry strategy: Analysis of possible ways to enter the market, along with knowledge of how existing companies have entered the market, including key contracts, alliances, and strategic initiatives.

- Competitive landscape and strategic insights: Analysis of the competitive landscape of defense manufacturers in India. It provides an overview of the key defense companies (both domestic and foreign) along with insights such as key alliances, strategic initiatives and a brief financial analysis.

- Business environment and country risk: A range of drivers at country level, assessing business environment and country risk. It covers historical and forecast values for a range of indicators evaluating business confidence, economic performance, infrastructure quality and availability, labor force, demographics, and political and social risk.

Scope

- Analysis of defense industry market size from 2005 through 2010 and forecasts till 2016

- Analysis of defense budget allocation

- Benchmarking with key global markets

- Market opportunities

- Defense procurement dynamics

- Industry dynamics

- Market entry strategy

- Competitive landscape and strategic insights

- Business environment and country risk

Reasons to Buy

- Gain insight into the Indian defense industry with current, historic and forecast market values

- Get insight into market opportunity and attractiveness

- Get insight into industry procurement dynamics

- Gain insight into industry structure

- Gain insight into regulations governing the Indian defense industry and the potential market entry strategies with an expert analysis of the competitive structure

- Identify top companies of the Indian defense industry along with profiles of all those companies