The Department of Defense is endeavoring to safeguard its portfolio of weapon acquisition programs as it prepares to absorb hundreds of billions of dollars worth of budget cuts over the next decade. These cuts stem from a debt-reduction plan agreed upon by Congress last summer known as the Budget Control Act of 2011, though the precise scope of the cuts facing the Pentagon budget remains to be seen.

The DoD’s fiscal situation is dire news for a force attempting to rebuild and modernize after a decade of war, according to Forecast International’s latest analysis of the U.S. defense market. “The budget debate raises some serious questions about many of the department’s costly acquisition programs, as well as the overall size of the military and the manner in which the force will be utilized in future conflicts,” said Shaun McDougall, Forecast International’s North America Military Markets Analyst and author of the report.

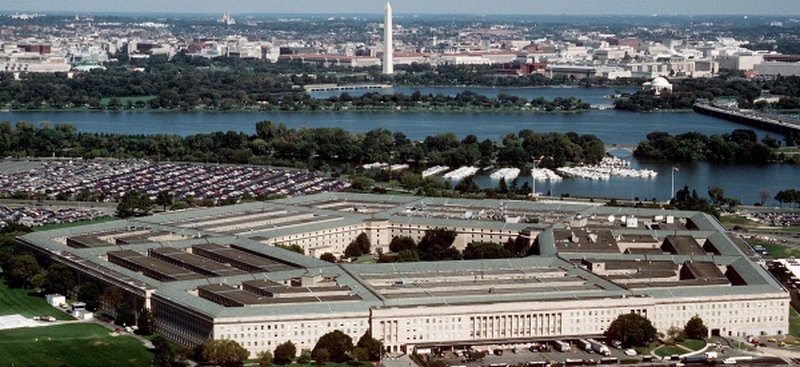

The Pentagon is already implementing over $150 billion worth of efficiency savings under an effort launched by former Defense Secretary Robert Gates, and budget planners anticipate that the debt ceiling agreement will result in cuts of more than $450 billion over the next decade. Furthermore, a joint committee recently failed to identify $1.2 trillion worth of additional federal budget cuts, triggering a legislative mechanism that would automatically split those cuts between security and non-security programs.

“This second round of defense budget cuts is not set in stone, however, because lawmakers still have a number of options for reversing course or modifying the legislation they passed earlier in the year,” McDougall said. Nevertheless, service leaders are preparing for the worst as they attempt to shield their prized acquisition efforts from the budget axe.

Even as the DoD completes a strategic and budgetary review to guide future budget cuts, deciding which programs to end or curtail will be a monumental undertaking.

The Air Force may be hard-pressed to afford every F-35 that it currently plans on buying, and fiscal pressure could impact the development of a new long-range bomber.

The Navy must decide whether to stand by its requirement for a 313-ship fleet, which some estimates suggest is unattainable given current budget trends and unaffordable under even the best-case scenarios. The projected cost of the SSBN(X) ballistic missile submarine will only add to the pressure on the Navy’s shipbuilding accounts down the road. Naval aviation also faces uncertainty as larger budget cuts loom, with the F-35B and V-22 standing out as potential targets.

The Army may face a particularly difficult time moving forward. As its footprint in the Middle East dwindles and the size of the Army declines, the service will lose some of the momentum behind its budget requests. Yet the Army still intends to develop a new family of ground vehicles under a program that has already been delayed because of cost concerns, while it recovers from two failed efforts to develop a new armed scout helicopter.

Pentagon leaders have echoed the sentiment that defense strategy should not be driven by budget cuts, but that it must be informed by budget constraints. These constraints will be a decisive factor in the DoD’s acquisition pipeline moving forward, and have already made an impact in the form of more fixed-price contracting, the canceling or restructuring of programs that are underperforming or over budget, and the pursuit of more off-the-shelf solutions in place of complicated and expensive development efforts.

What is unclear at this time is how far the Pentagon will have to go to adapt to this new fiscal reality.

Forecast International, Inc. is a leading provider of Market Intelligence and Analysis in the areas of aerospace, defense, power systems and military electronics. Based in Newtown, Conn., USA, Forecast International specializes in long-range industry forecasts and market assessments used by strategic planners, marketing professionals, military organizations, and governments worldwide.