The global military land vehicles market is undergoing a transition. Many countries have been forced to curtail their defence spending and as a result, vehicle programs in the West are being delayed or facing reduction in procurement numbers. Even though some notable land vehicle modernization programs are under development and even deployment, the market future is uncertain. Recognizing ongoing trends and adapting to the change is essential for future success in the industry.

According to Frost & Sullivan’s recent analysis, the global military land vehicles market is expected to witness a slow growth at a Compound Annual Growth Rate (CAGR) of 0.7 per cent during 2012 – 2021.

The reason for the short term slowdown is decline in the Western defence markets. Currently the global military land vehicle market is dominated by the United States.

However, expected cuts in major U.S. vehicle programs will result in a decline of 1.5 percent. Growth momentum will pick up again in the medium term as the APAC and Middle East markets reach procurement phase. The Western market will offer opportunities in the form of upgrades and capability sustainment.

“Countries in Europe and North America intend to get rid of legacy equipment, but the new vehicle procurement numbers in traditional Western defence markets will decline in the future,” notes Frost & Sullivan Senior Research Analyst, Mahendran Arjunraja. “Suppliers can no longer rely on one country and will be forced to focus on multiple markets in APAC and the Middle East to remain profitable.”

The changing nature of warfare and ever increasing cost of military operations are forcing military planners to rethink their future vehicle capabilities. Future military operations will be asymmetric and forces have to operate in urban environments. Mobility, modularity, protection and compatibility with other battlefield elements are key attributes for future vehicles to protect against contemporary threats in a cost efficient way. The need for agile vehicles will, in turn, boost demand for light weight and hybrid vehicles.

Looking for new advanced solutions, end users are also increasingly interested in modular platforms that offer more benefits than conventional vehicles. Similarity in components reduces the vehicle life cycle cost and also enables a lean supply chain. “Having a fleet of modular vehicles allows the end user to use a single vehicle for different applications by modifying and configuring specific components,” explains Mr. Arjunraja. “This flexibility increases the preference for modular vehicles and we expect significant future growth in the segment.”

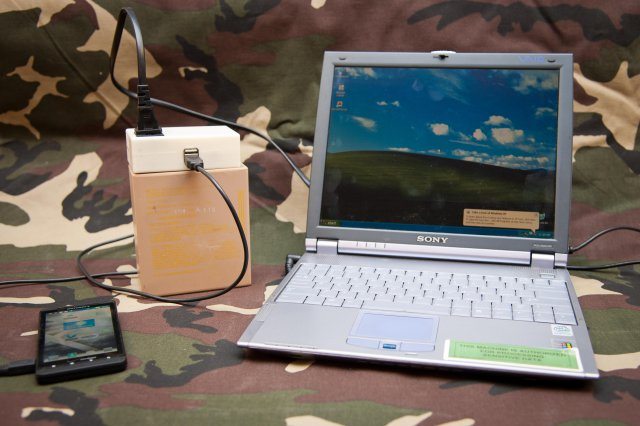

“As ‘quality over quantity’ is getting more and more important, offering a cost efficient solution will be a major challenge for the suppliers,” summarizes Mr. Arjunraja. “While the government authorities place strong emphasis on reducing system acquisition and sustainment costs, Commercial off the Shelf (COTS) is a way to realize cost savings. Over the last few years the use of COTS has gradually increased and should encourage more commercial suppliers to offer military solutions.”