MOUNTAIN VIEW, Calif.: The U.S. Department of Defense (DoD) is expected to offset a dip in research, development, test, and evaluation (RDT&E) with a hike in spending on ground forces supplies, services, and technologies. Command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) funding is likely to remain stable, with robust growth restricted to current deployments and applications that have direct relevance to counter-insurgency/terror operations.

Open-source intelligence (OSINT) and human intelligence (HUMINT) will be helpful in successful counter-terror/insurgency warfare.

New analysis from Frost & Sullivan, U.S. DoD C4ISR Markets, finds that the 2011 U.S. DoD C4ISR budget requests $43.3 billion. This is a $600.0 million increase over the 2010 enacted level. C4ISR spending continues to account for about 6.1 percent of the total DoD budget.

The DoD will be particularly focusing on intelligence and special operations and therefore, repair, maintenance, training, information assurance, and operational services will continue to be funding priorities.

“Funding by segment reflects an attempt to rebalance technical sensors/collection with less expensive but vital analysis and other ‘people’ skills required for successful military operations,” says Frost & Sullivan Industry Analyst Brad Curran. “Intelligence activities of all types will have the largest growth rate through 2015.”

“There is a great need for C4ISR services such as language and cultural skills, maintenance, engineering, integration, training, project management, especially for the popular information assurance and coalition partnering applications,” notes Curran. “Surveillance & Reconnaissance is also receiving robust funding as unmanned vehicles and improved sensors are deployed, new units are stood up, and existing unit Tables of Equipment are expanded.”

Considerable investments are required for the upgrade of neglected ‘conventional’ capabilities, increasing the DoD’s spending. There is substantial demand for practical, rapid, and inexpensive platforms such as balloons and commercial-off-the-shelf (COTS) tools such as WiFi.

With the trend of collaboration through social media gaining currency in operational and intelligence communities, continued investment in network infrastructure, software analysis, and dissemination tools is necessary.

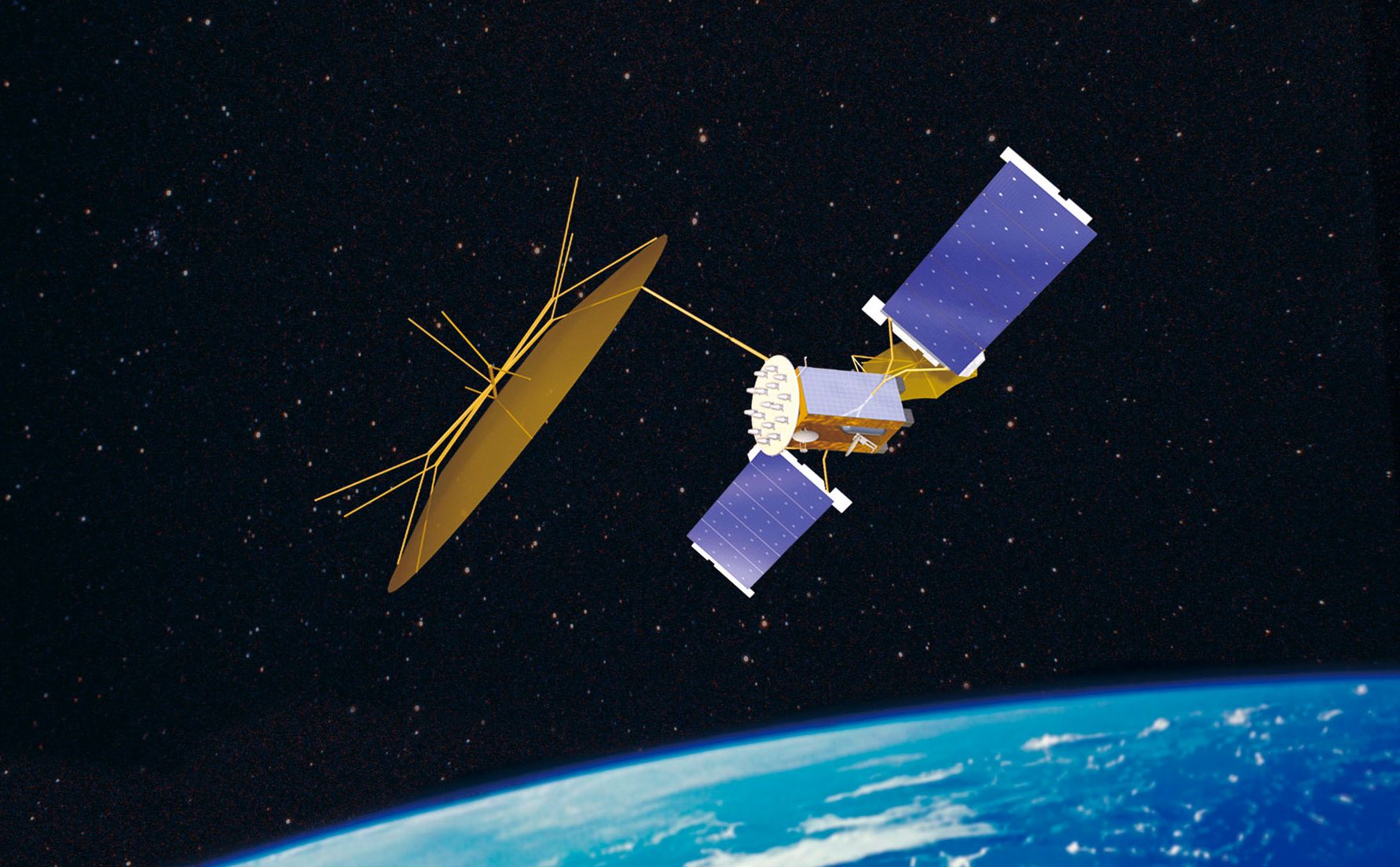

Meanwhile, the DoD continues to make cuts in space budgets. While export controls constrain international sales, the commercial and foreign competition constantly escalates. Overall, there are likely to be fewer platforms of all types. Future sales trends are likely to move away from high-end platforms toward proven and reliable designs that afford maximum flexibility.

Frost & Sullivan enables clients to accelerate growth and achieve best-in-class positions in growth, innovation and leadership. The company’s Growth Partnership Service provides the CEO and the CEO’s Growth Team with disciplined research and best-practice models to drive the generation, evaluation, and implementation of powerful growth strategies. Frost & Sullivan leverages over 45 years of experience in partnering with Global 1000 companies, emerging businesses and the investment community from 40 offices on six continents.