The Air Force program to provide a new ground-based, long-range radar system is moving forward with a revised acquisition strategy. The program office recently held an industry day here to explain the changes and its latest draft request for proposal.

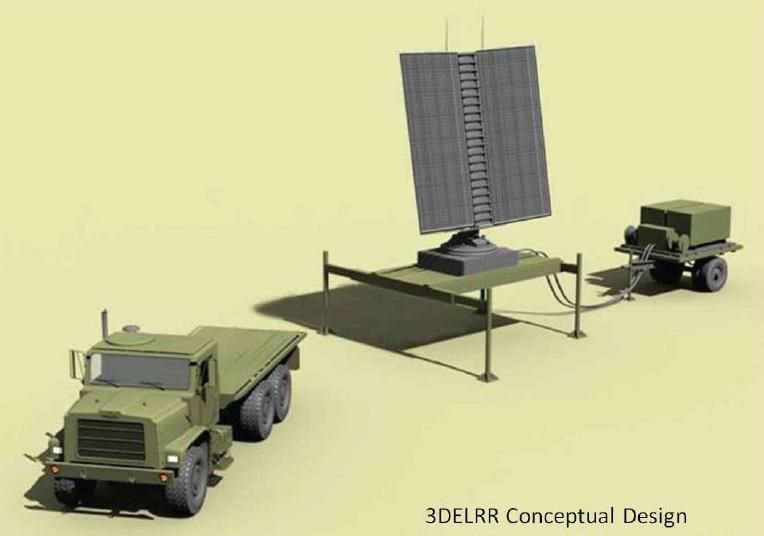

The Three-Dimensional Expeditionary Long-Range Radar, or 3DELRR, will be the principal U.S. Air Force long-range, ground-based sensor for detecting, identifying, tracking, and reporting aircraft and missiles in support of theater commanders. It will replace the current Air Force radar, the TPS-75.

“A combination of several factors, including a somewhat atypical acquisition strategy and the U.S. budget crisis, led to the change,” said Lt. Col. Brian McDonald, 3DELRR program manager.

A September 2007 memorandum from John Young, then the acting undersecretary of Defense for Acquisition, Technology, and Logistics, encouraged competitive prototyping up to Milestone B. Originally, the 3DELRR Program had been planning to award to a single contractor prior to Milestone B.

“We modified the strategy to further leverage competition to look at needed capability, different approaches to delivering that capability and doing so in the most affordable manner,” McDonald said.

During the industry day briefing, he also showed how the program budget had been reduced in the Fiscal Year 2013 President’s Budget by approximately $80 million over the next five years compared to the 2012 budget.

McDonald cited industry offerings as a third factor.

During his presentation in the base theater, McDonald walked through a graphical depiction of the revised acquisition strategy and the changes that have been made.

Now, up to three contracts may be awarded as an outcome of the upcoming full and open competition to complete the Technology Development Phase, referred to as the Pre-Engineering and Manufacturing Development (Pre-EMD) period. The 3DELRR source selection will use the lowest price technically acceptable approach, which is also a significant change.

“Competitive offerors must be at the same maturity level as the government has attained on this program,” said McDonald. “We do not want to turn back the clock. We want to move forward from the government investment to date.”

In addition, fixed price contracts, including Firm Fixed-Price and/or Fixed-Price Incentive Firm, are planned for the Pre-EMD, EMD, and low rate initial production phases from what was once a cost plus incentive fee approach.

The revised strategy includes a minimum of three full and open competitions to reach full operational capability. McDonald pointed to the third competition that will award scope beyond Milestone B to a single contractor.

“There will be much activity, in parallel, leading up to Milestone B,” explained McDonald. “We will need a strong, crisp effort by industry on these contracts while the program office simultaneously conducts the next source selection and prepares for Milestone B.”

One change that McDonald strongly emphasized was the early examination of cost versus capability trade-offs. While there has been no change in the 3DELRR requirements since Technical Requirement Documents Revision D was posted in October 2011, McDonald explained the plan to issue a new revision, during the period of performance, against which successful bidders would produce their preliminary designs.

“We need to look closely at cost versus capability,” he said. “The first contractual activity is to complete detailed analyses of top cost drivers to see how cost varies as capability is incremented. Are there relatively large cost savings to be gained by relatively small reductions in capability and, if so, what’s the risk?”

McDonald discussed how the acquisition community and operational community will then come together to set 3DELRR requirements.

The 3DELRR program has also been selected as a “designated system” to participate in the Defense Exportability Features Pilot Program, to potentially increase sales and lower production costs.

“I’m excited to be a pilot for the Defense Exportability Features Program because it’s forward thinking, it’s good for the U.S. government and it’s good for U.S. industry,” McDonald said. Addressing the audience of mostly company representatives, he added, “I hope you’re excited too.”

The 3DELRR Program Office is planning for a Defense Acquisition Board in late April and, if approved, anticipates release of the final RFP in May. Currently, the program office expects to award the contracts, totaling approximately $108 million dollars, by late August.

“No one is immune from the budget crisis,” said McDonald. “This acquisition strategy is our response. Now, we need strong industry performance to offer the most affordable solution that provides this needed capability to our warfighters.”